In 2022, most of the top 50 global security companies have achieved significant growth. However, this year is coming to an end, and the security industry is facing many new problems. These "uncertainty" factors will become a major challenge in the coming year.

.png)

2022 Global Security Top 50 List

Sales revenue of the top 10 global security companies in 2021 (unit: US$ million)

A total of 6 new companies appeared on this year's list, namely Di Nike, Zhongwei Century, Liding Optoelectronics, Evolv (USA), Ava Group (Australia), and Webgate (South Korea).

In the list, in addition to companies from Taiwan, a total of 15 companies from mainland China are on the list. Among them, Hikvision, Dahua, Uniview Technology, and Tiandi Weiye are all in the top ten. Overall, most Chinese companies have achieved substantial growth in 2021, which also demonstrates the resilience of domestic companies in the face of foreign trade sanctions.

However, in the first half of 2022, the revenue of most Chinese companies showed a year-on-year decline. Taking Hikvision as an example, although its revenue increased by 9.9% in the first half of 2022, its total profit was 848.6 million US dollars, compared with 2021. In the first half of 2019, it fell by 11.14%, the main reason of which was related to the domestic epidemic. In the first half of this year, due to domestic epidemic prevention and control, mobility in some urban areas was restricted, and project implementation was delayed, resulting in limited business development.

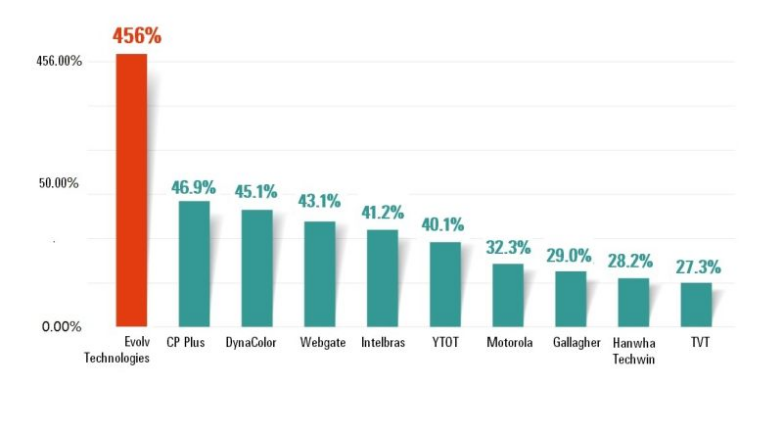

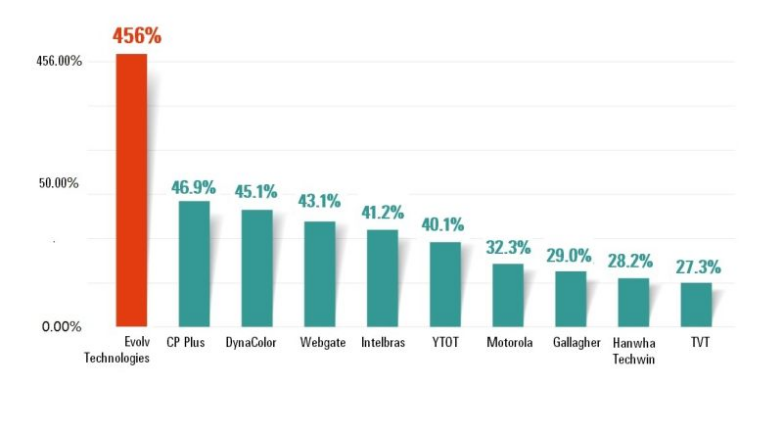

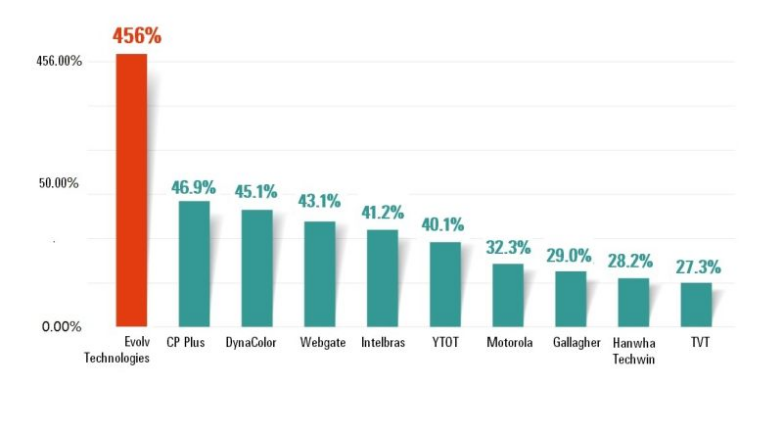

In this year's list, a total of 40 companies achieved growth last year, of which 28 companies achieved double-digit or even triple-digit growth. The top 10 fastest growing companies in 2021 are: Evolv Technologies, CP Plus, DynaColor, Webgate, Intelbras, Yutong Optics, Motorola Solutions, Gallagher, Hanwha Techwin and Tongwei.

Top 10 fastest growing companies in 2021

Among them, Evolv, an American AI non-contact security inspection system supplier, will only earn US$3.92 million in 2020, and its revenue will grow to US$21.77 million in 2021, a year-on-year increase of 455.98%. The expansion of the market has covered more customer groups.

2021-2022 Year in Review : Security Market Returns to Growth

Looking back on 2021-2022, due to the alleviation of the impact of the epidemic, the security market began to return to the normal track. Frost & Sullivan analysts believe that as the impact of the epidemic weakens, in order to allow employees to return to the office, companies are making efforts to create a safer office environment, while continuing to invest in remote office solutions implemented during the epidemic. In general, the global security market has gradually returned to the level before the epidemic, coupled with the current demand for digital upgrading of customer business, such as biometrics, access control, video analysis, digital intelligence and other application markets will have significant growth.

Axis CEO Ray Mauritsson said that the global security market has plenty of room for growth in the past year, one of the driving factors is that people pay more attention to security and network video solutions, and with the mature development of technology, innovative Products and solutions are constantly meeting the new application requirements of users.

Outlook 2023 : Challenges Ahead

Just as the impact of the epidemic is coming to an end, new challenges and difficulties have emerged, which will have a major impact on security and other industries. The surge in market demand after the COVID-19 pandemic, geopolitical conflicts and other factors have triggered the industry's most serious supply chain crisis, which to a certain extent has led to a series of inflation and loss of control in the global energy, food and even consumer goods markets. In order to curb inflation, the current interest rate has reached the highest level in history, triggering the panic of global economic recession. In fact, the new crown epidemic has caused the global economic development to deviate from the original track, and many past judgments and predictions have lost their meaning. Although the global security market is still trying to restore growth, the above-mentioned challenges will become a key factor in the development of the industry in the coming year. uncertainty factor.

supply chain issues

As mentioned above, one of the challenges that the security industry is facing is the most serious supply chain shortage in history. "The blockade of different degrees around the world caused by the epidemic is one of the factors, and the shortage of key components is another main reason. During the epidemic, the above situation was even more severe. Manufacturers could only try to reduce the impact by redesigning products or purchasing replacement solutions in the spot market. But either way, the normal delivery time cannot be guaranteed, which makes most manufacturers in The growth in the past two years has been lower than expected. With the improvement of the supply chain, it is expected that Axis can return to the double-digit growth level.” Ray Mauritsson said.

Of all the component shortages, semiconductors are the worst. Therefore, this has a serious impact on security manufacturers. "The control of the new crown epidemic has restricted people's daily activities, which has stimulated the demand for consumer electronics. Home office and distance learning have allowed home users to spend more on home electronics. These devices require semiconductors, resulting in a sharp increase in demand. Growth. Video surveillance equipment makers are just one group vying for semiconductor supply, along with automakers and smartphone makers,” said the analyst.

“In terms of these component types, the most affected are processor chips for analytics, intelligence or edge functions. These are high demand in user solutions, so ensuring the timely supply of these components will help. It can be the key to winning projects last year. Security equipment suppliers with diversified supply chains can reduce the impact of shortages and became the ultimate winners in the market last year." The analyst added.

inflation

The phenomenon of inflation is now also affecting industries including security. “Prices of surveillance equipment around the world are being affected by inflationary pressures in the wider economy. With the rapid rise in the cost of utilities, labor and raw materials, video surveillance suppliers will be forced to increase the price of equipment. As things stand, it can be expected that network The average price of a camera will rise in both 2022 and 2023," said the analyst.

In the case of rising prices, security manufacturers have to re-formulate strategies and find ways to retain customers. Inflation has led to cost increases across the board, and security components are no exception. In response to this situation, many suppliers and integrators have had to raise prices, but they also offer customers more flexible payment methods, after all, many current projects will take longer than before. In addition, the industry's focus has shifted to improving the overall customer experience, such as providing a more personalized service model. This service-based approach is not only in line with general trends in the industry, but also helps providers protect customers from churn.

other challenges

The risk of geopolitical conflicts in some regions of the world has emerged, and it has also caused huge losses to many security companies. For example, the impact of the conflict between Russia and Ukraine has caused many security companies to suspend their business in Russia.

Recently, there are rumors that new data privacy protection regulations are about to be introduced, which continues to affect the global security industry. Analysts said that because of many uncertain factors, manufacturers should start to build new solutions to meet the corresponding data protection regulations of countries around the world, and on the other hand, they need to strengthen the flexibility of the solutions so that they can be modified quickly and keep up with the market demand.

Growth decline in 2023 is inevitable

The global security industry will usher in growth in 2022. As for the situation next year, many uncertain factors may lead to market adjustments and affect market growth.

The analyst said, "The global video surveillance hardware and software market is expected to grow by 11.7% in 2022. Global economic conditions will have an impact on public and personal video surveillance equipment spending in 2023. At the same time, inflationary pressures still exist. The global video surveillance hardware and software market will grow by 6.4% in 2023. Although the global security market will not experience a decline in overall indicators in 2023, various factors are indicating that the market will enter a new adjustment period, and double-digit growth may not be maintained , will fall back to the year-on-year growth rate of 8-9%.”

"Inflation concerns, supply chain shortage challenges and global energy market instability. All will cause customers to suspend investment in many new security projects until the input-output ratio meets or exceeds their expectations. But opportunities and crises coexist, This also creates opportunities for closer cooperation between security equipment manufacturers and users, from pure security solution supply to digital solution supply. At present, many manufacturers have introduced more new intelligent technologies and applications, etc., to communicate with users Discuss or provide trial, in order to seize market opportunities when a new round of investment starts." The analyst added.

Enquiry Contact:

Kevin Chao

sales@bit-cctv.com

+86-139-2068-8922

English

English 日本語

日本語 한국어

한국어 français

français Deutsch

Deutsch Español

Español italiano

italiano русский

русский português

português العربية

العربية tiếng việt

tiếng việt ไทย

ไทย čeština

čeština dansk

dansk Svenska

Svenska

.png)